The Citi Grandmaster Index

Designed to Adapt to Changing Market Conditions

When Citi designed the Citi Grandmaster Index, they recognized that asset allocation models should seek to anticipate changing market conditions and attempt to incorporate those factors into asset allocation decisions. Citi’s Investment Strategy team focuses on the design and implementation of innovative indexed investment strategies and solutions which leverage Citi’s global capital markets expertise.

The Citi Grandmaster Index

Citi utilized this collective expertise in the design of the Citi Grandmaster Index (the Index). The Index is designed to seek more consistent returns through changing market environments, and is founded on three core principles:

Broad Diversification

- To help provide more sustainable opportunities for growth, the Index provides global diversification across equities, government bonds, commodities and corporate credit.

Forecasting Return

- The Index forecasts 1,000 future market return scenarios by combining recent returns over the last year and comparing recent performance to historical periods where the market exhibited similar behavior.

Dynamic Optimization

- The Index then optimizes the asset-class weights by identifying the sequence of consecutive monthly weights expected to deliver the highest risk-adjusted return over the next year.

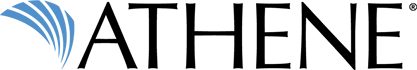

Benefit from Broad Diversification

The Index provides global diversification in four asset classes spread across 13 constituents and 3 geographies (United States, Eurozone and Japan). Four relatively uncorrelated asset classes across equities, government bonds1, commodities and corporate credit provide the flexibility to adapt to a wide variety of market conditions and contribute to returns.

Global Growth Opportunities

1 Government bond asset allocation is dependent on the Dynamic Bond Cap. The Dynamic Bond Cap is the maximum allocation to Government Bonds. Exposure is determined each month based on the U.S. yield curve and breakeven inflation rates.

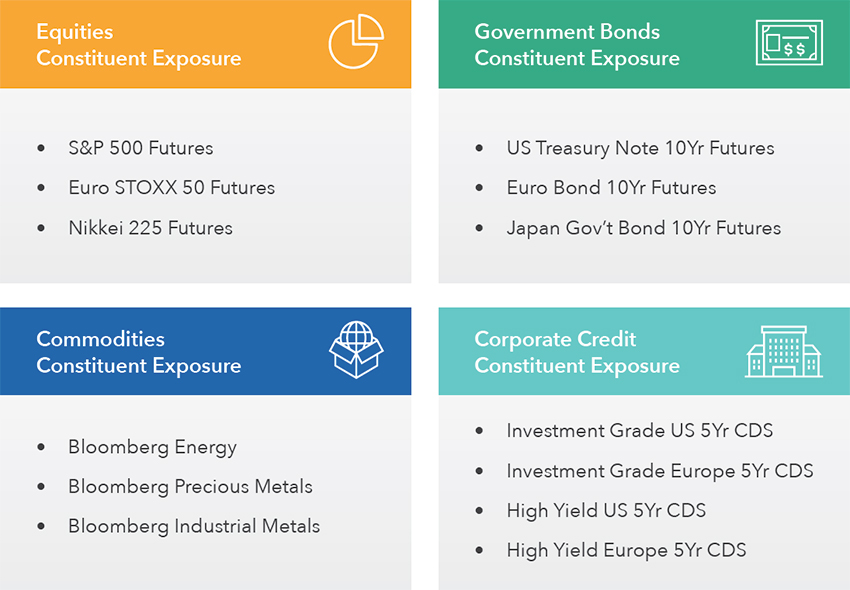

Citi’s Dynamic Optimization Process

The Citi Grandmaster Index looks at the market performance of each asset class over the last year and at periods of similar historical volatility to simulate hypothetical future return scenarios over the next year. Over time, updated market information continues to be incorporated in the index to simulate potential future return scenarios that drive the asset selection process.

Monthly Optimization Process

The Index applies a dynamic daily risk control overlay that looks at volatility measured by both the VIX and the historical volatility to help stabilize returns through changing markets. If daily volatility falls below 5%, the Index may increase its allocation to the selected asset classes up to 150%. If daily volatility is greater than 5%, exposure can be reduced below 100%.

The index performance is reduced by 0.50% per annum, deducted daily.

Visit investmentstrategies.citi.com/cis/us to learn more about the Citi Grandmaster Index.

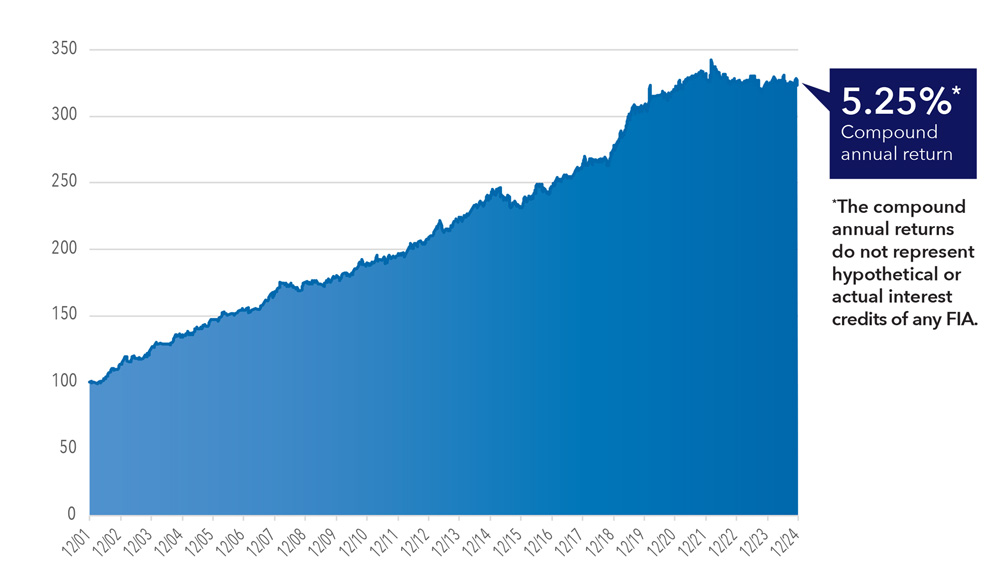

An Opportunity for Stable Growth

The Citi Grandmaster Index’s forecasting methodology utilizes additional historical data as it becomes available, adjusting allocations with the aim to deliver the highest risk-adjusted return and adapt through various market environments. The graph below shows how the Citi Grandmaster Index would have provided steady appreciation since 2001.

Citi Grandmaster Index Hypothetical Performance

Important Information about Hypothetical Back-Tested Index Performance Data

*Hypothetical Assumptions: Index value of the Citi Grandmaster Index from 12/31/2001 to 12/31/2024. All Index performance data prior to April 20, 2021 is hypothetical and back-tested, as the Index did not exist prior to that date. Hypothetical back-tested Index performance data is subject to significant limitations. The Index Administrator developed the rules of the Index with the benefit of hindsight – that is, with the benefit of being able to evaluate how the Index rules would have caused the Index to perform had it existed during the hypothetical back-tested period. The fact that the Index generally appreciated over the hypothetical back-tested period may not therefore be an accurate or reliable indication of any fundamental aspect of the Index methodology. Furthermore, the hypothetical back-tested performance of the Index might look different if it covered a different historical period. The market conditions that existed during the hypothetical back-tested period may not be representative of market conditions that will exist in the future. Moreover, the hypothetical back-tested performance of the Index was based on a particular random distribution of historical returns to construct each hypothetical market simulation, using a different random number generator than the Index currently uses. Each random distribution of returns is different, and so the hypothetical back-tested performance is different from the performance that would have resulted if the Index had actually existed during the back-tested period.

For more information about the BCA Suite of Annuities, please ask your insurance professional

About Citi

Citi provides a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management. With a physical presence in 96 countries, local trading desks in 77 markets and a custody network in 63 markets, Citi facilitates approximately $4 trillion in financial flows daily.